Breakthrough Therapy Designation Market Growth, Size, Trends, CAGR Status and Future Outlook

Breakthrough Therapy Designation Market Growth, Size, Trends Analysis - By Application, By End User - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

| Published: Apr-2025 | Report ID: HLCA25107 | Pages: 1 - 244 | Formats*: |

| Category : Healthcare | |||

| Report Metric | Details |

| Market size available for years | 2021-2034 |

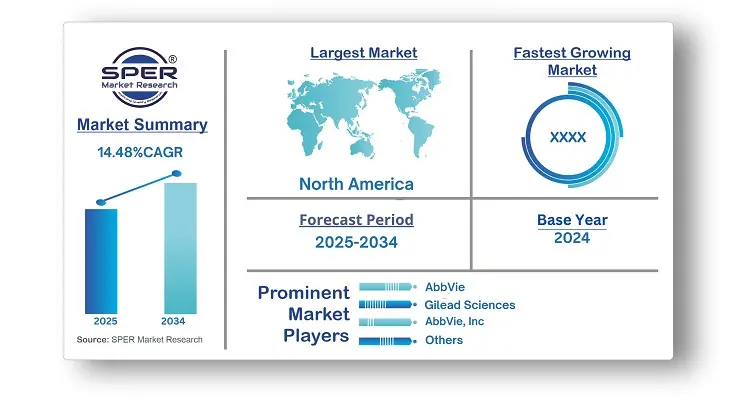

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Application, By End User |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | F. Hoffmann-La Roche Ltd, Novartis AG, Pfizer, Inc, AbbVie, Inc, Bristol-Myers Squibb Company, Gilead Sciences, Inc, Sanofi, Regeneron Pharmaceuticals Inc, AstraZeneca, Boehringer Ingelheim GmbH. |

- Global Breakthrough Therapy Designation Market Size (FY’2021-FY’2034)

- Overview of Global Breakthrough Therapy Designation Market

- Segmentation of Global Breakthrough Therapy Designation Market By Application (Oncology, Infectious Diseases, Rare Diseases, Autoimmune Diseases, Pulmonary Diseases, Neurological Disorders)

- Segmentation of Global Breakthrough Therapy Designation Market By End User (Hospitals, Clinics, Research Institutes, Laboratories)

- Statistical Snap of Global Breakthrough Therapy Designation Market

- Expansion Analysis of Global Breakthrough Therapy Designation Market

- Problems and Obstacles in Global Breakthrough Therapy Designation Market

- Competitive Landscape in the Global Breakthrough Therapy Designation Market

- Details on Current Investment in Global Breakthrough Therapy Designation Market

- Competitive Analysis of Global Breakthrough Therapy Designation Market

- Prominent Players in the Global Breakthrough Therapy Designation Market

- SWOT Analysis of Global Breakthrough Therapy Designation Market

- Global Breakthrough Therapy Designation Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.

Frequently Asked Questions About This Report

PLACE AN ORDER

Year End Discount

Sample Report

Pre-Purchase Inquiry

NEED CUSTOMIZATION?

Request CustomizationCALL OR EMAIL US

100% Secure Payment

Related Reports

Our Global Clients

Our data-driven insights have influenced the strategy of 200+ reputed companies across the globe.